Whitepapers & E-Books

Understanding pension payments

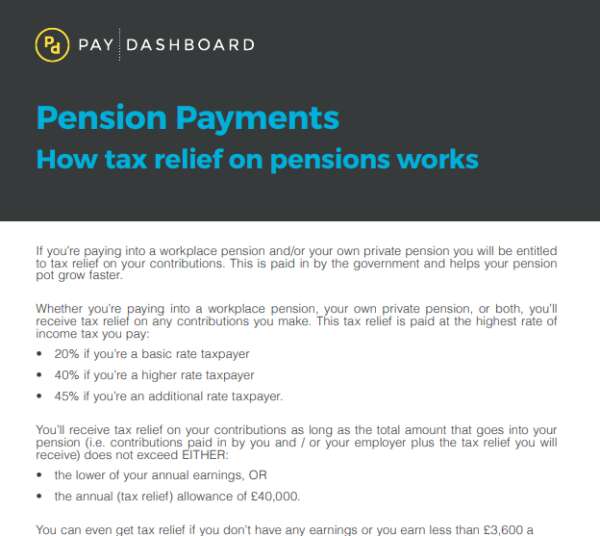

Many employees already have either a workplace or personal pension. However, most employees don't even know that there are actually two ways to claim tax relief on a pension - and depending on the type of pension scheme that they have, the employee may need to fill in a self-assessment tax return in order to claim the full tax relief on pension contributions.

Download this resource

Please complete the form below to access this information