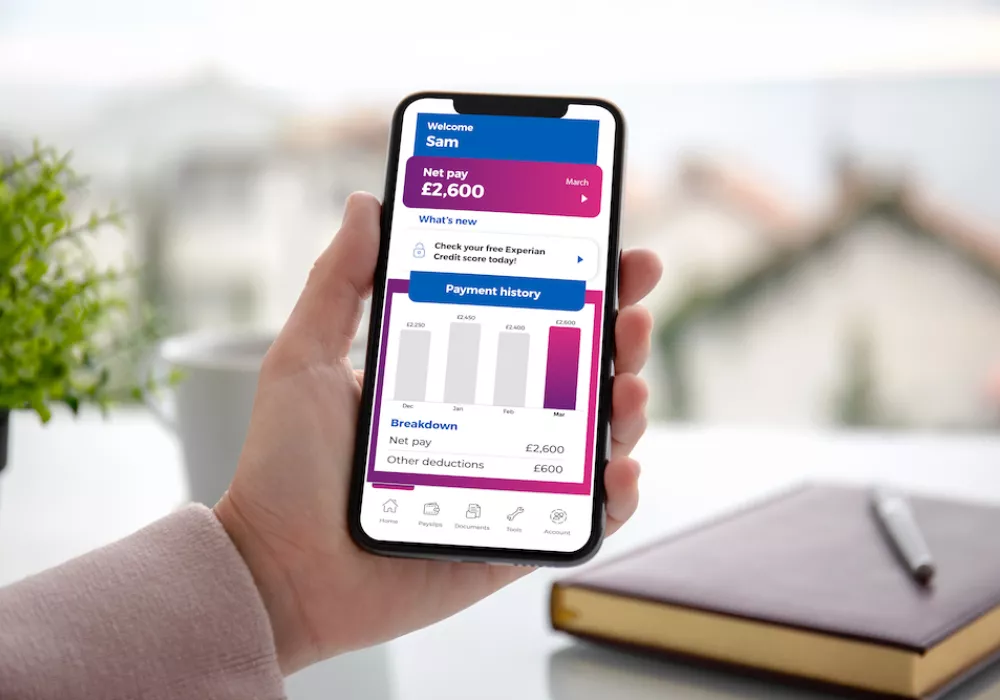

PayDashboard is a simple and low-cost web portal and mobile app that brings pay, reward and financial wellbeing together in one place

Turning payday into an engaging and interactive experience, PayDashboard helps employees to understand the true value of their pay and reward package, and to identify any benefits and allowances they may be entitled to.

The portal integrates with your chosen payroll and reward software, and getting started is quick and easy. Simply upload payroll files to deliver PAYE forms (P60, P45, P11d), letters, total reward statements and guidance articles, alongside interactive and engaging payslips. Users can access their secure digital payslip via the browser or mobile app on their device, in a language of their choice, with multi-factor authentication (MFA) to protect their data.

PayDashboard suits a variety of audiences and business needs

Employers

PayDashboard enables you to deliver the tools that your employees need to build their financial knowledge and confidence to navigate life’s big moments. Integrate with your chosen payroll and HR systems for a bespoke employee pay and benefits experience, customising the platform with the features you want, to create a seamless, personalised employee experience.

Payroll Providers

PayDashboard integrates with your chosen payroll software, offering a flexible and secure solution for payslip delivery. Personalise the platform with your brand’s logos and colours or create bespoke portals for your clients. PayDashboard provides one platform for payslips, PAYE forms, employee documents and client payroll reports – with options for clients to securely send documents to your payroll team via the portal as well.

Simply upload a payslip file and your clients benefit from a wealth of employee financial wellbeing tools that don’t complicate your payroll process.

Employees

With quick and simple set up, you get instant access to your payslip via web or mobile app. Your interactive payslip shows you what’s changed since last payday, as well as pay trends, helpful articles and tools, your credit score and previous payslips all in one place.

Software Providers

Whether you offer payroll software, HR software, or a benefits platform – you can integrate PayDashboard with your product to deliver added value for your clients. You’ll gain a low-effort, high-impact financial wellbeing product, helping you to win and retain clients and boost your bottom line in a competitive market.

With PayDashboard’s API, custom branding and SSO capability across web and mobile app, it is simple to add interactive payslips as an option for your clients. Even if your software does not handle payroll calculation, our existing integrations with payroll products enables a faster, more efficient way to add payslips to your suite of services.

How can I access PayDashboard?

We will provide a solution that fits with your budget and requirements, but you can rest assured that our data is collected, compiled and delivered to the highest possible quality.

Request a consultationThe benefits at a glance

Get in touch to find out how PayDashboard can help your business

Frequently asked questions

PayDashboard is a cloud-based digital payslip platform that integrates with your payroll software to provide employees with payslips and financial wellbeing tools. It offers more than just payslip access, helping employees track pay and improve their financial literacy.

Pricing for PayDashboard is flexible, typically based on a per-payslip or per-employee fee. This can be tailored to fit the specific needs of your organisation.

For payslips, PayDashboard supports upload of csv, xml and PDF files. Files can be uploaded manually or via automated STS upload, or transferred via API.

We support PDF uploads of PAYE forms include P60, P45 and P11d.

Our documents functionality supports all major file types include zipped folders for maximum flexibility when securely sharing data.

PayDashboard has instant, out-of-the-box integrations for a number of products including Sage 50, Moneysoft, Iris Payroll Professional, Iris Payrite, Iris Earnie, Superpay, Civica, Brightpay and Access Paycircle.

We have also worked with clients using Oracle (on premise and Fusion) and SAP – integrating via API or file upload.

PayDashboard is ISO27001 and Cyber Essentials certified. That means our product is subject to regular penetration testing, vulnerability scans, and audits as well as stringent access controls, security policies and data encryption. On top of all that we protect our products with multi-factor authentication and all data encrypted in transit and at rest to keep your data safe.